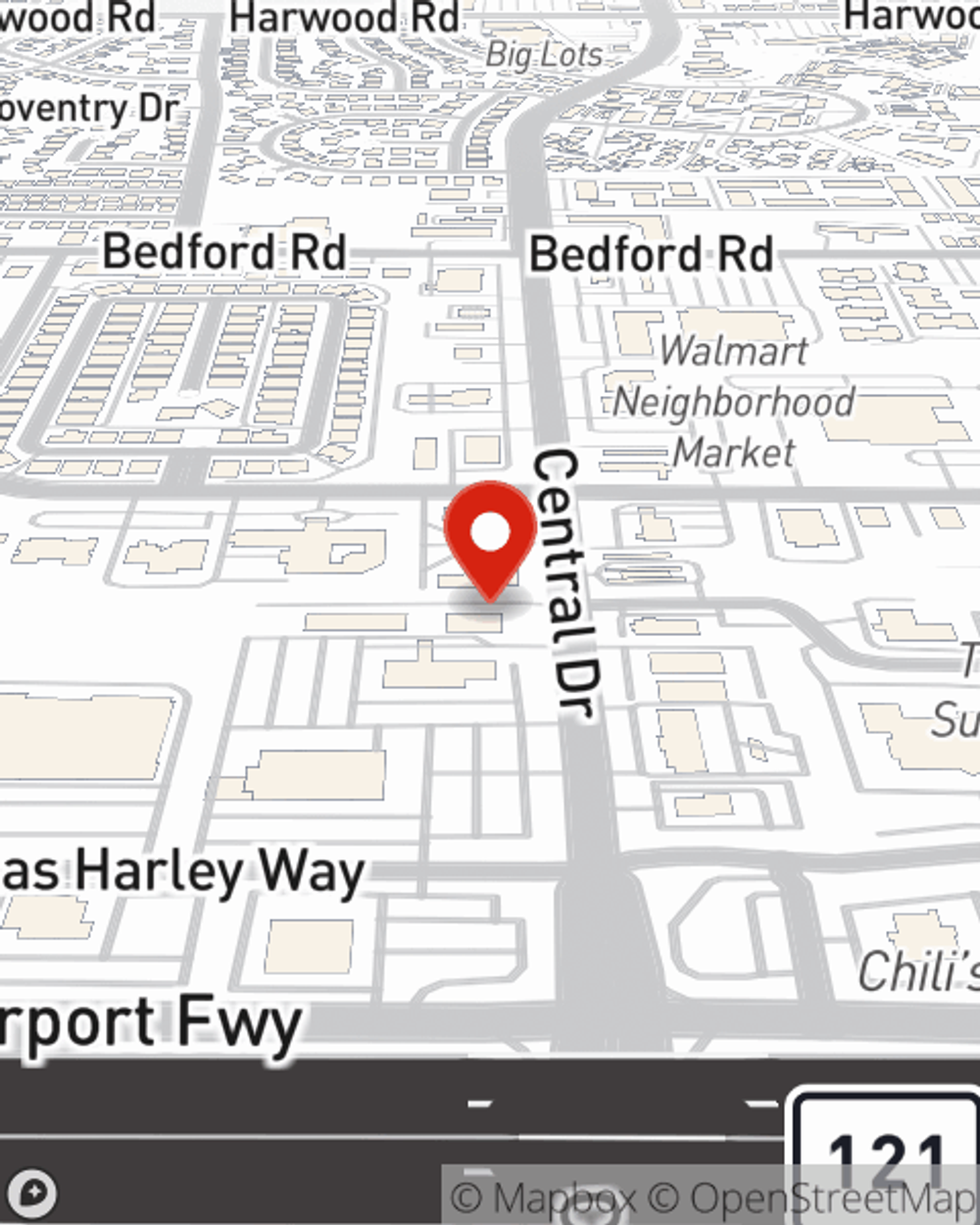

Business Insurance in and around Bedford

Looking for small business insurance coverage?

Insure your business, intentionally

Business Insurance At A Great Value!

Small business owners like you wear a lot of hats. From tech support to product developer, you do as much as possible each day to make your business a success. Are you a real estate agent, an optometrist or a physician? Do you own an auto parts shop, a music school or an ice cream shop? Whatever you do, State Farm may have small business insurance to cover it.

Looking for small business insurance coverage?

Insure your business, intentionally

Strictly Business With State Farm

Every small business is unique and faces specific challenges. Whether you are growing a beauty salon or a bagel shop, State Farm provides a large range of small business insurance options to help your business thrive. Depending on your space, you may need more than just business property insurance. State Farm Agent Kristie Polk can help with errors and omissions liability as well as key employee insurance.

The right coverages can help keep your business safe. Consider calling or emailing State Farm agent Kristie Polk's office today to explore your options and get started!

Simple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

Kristie Polk

State Farm® Insurance AgentSimple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".